-

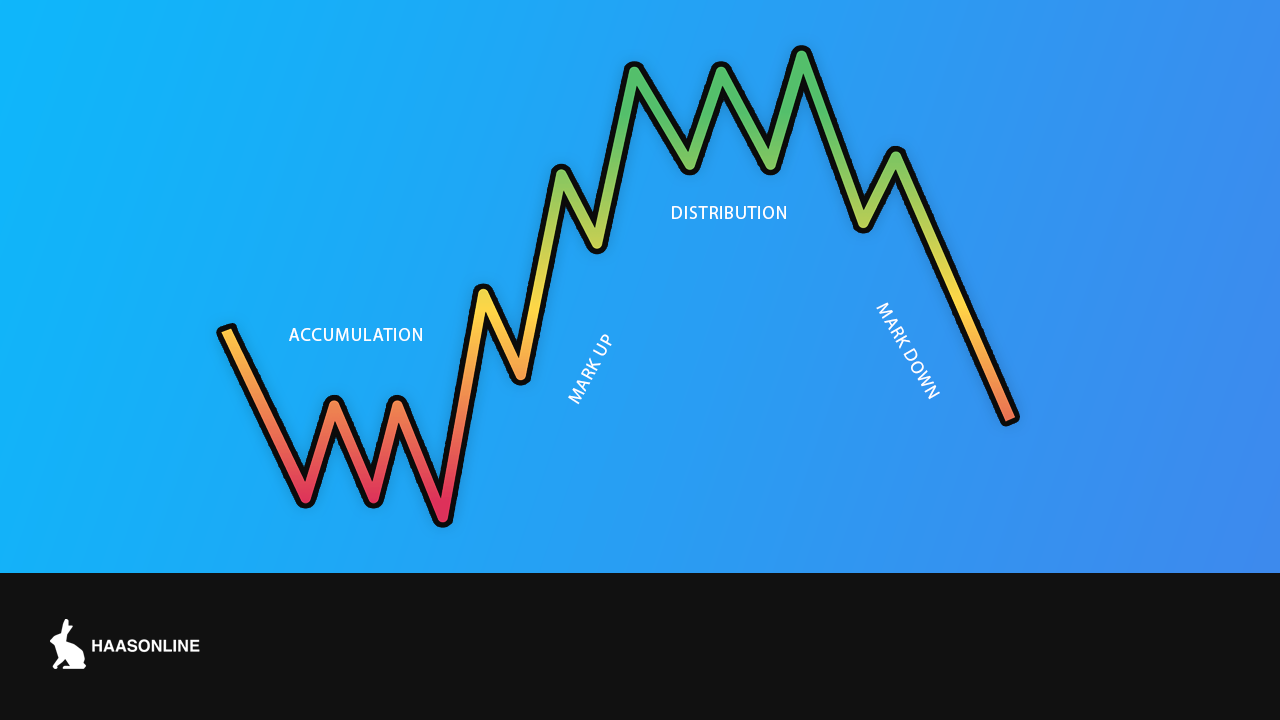

The Wyckoff Method with Crypto BotsJun 16, 20236m

-

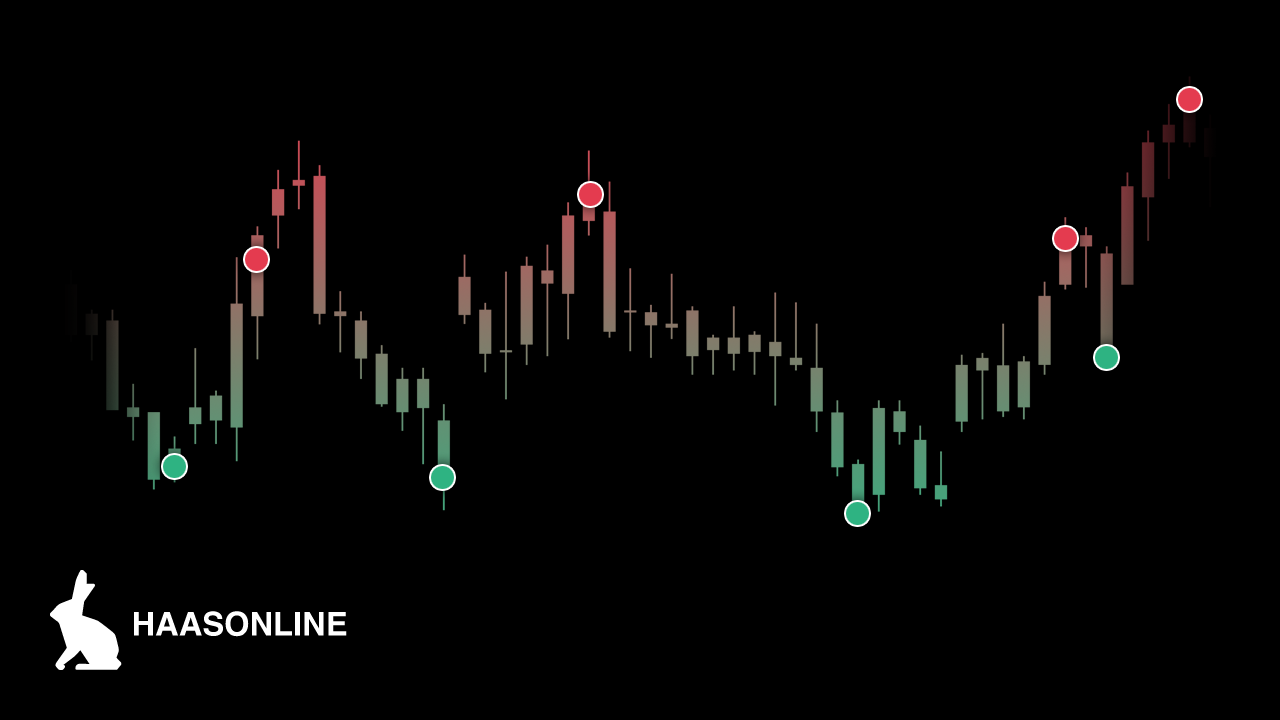

How to use a crypto scalping trading strategyJun 16, 20237m

-

Day trading crypto. Is it viable in 2021?Jun 16, 202315m

-

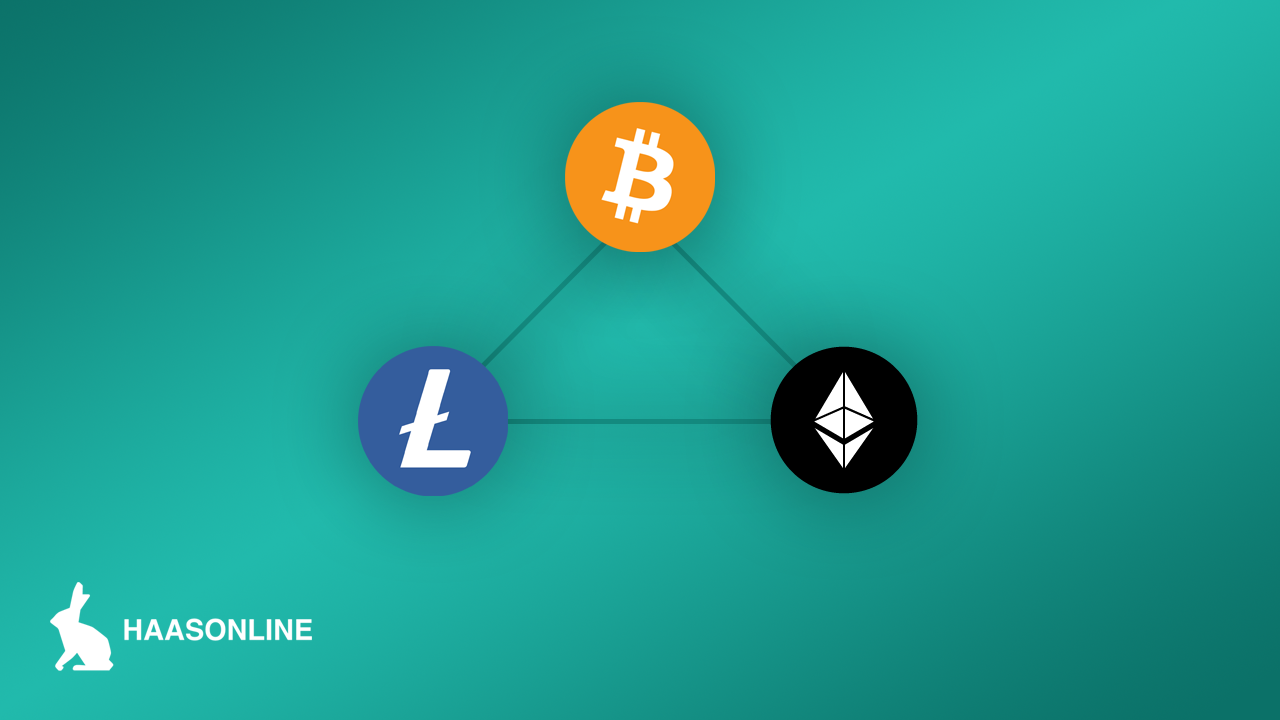

Does crypto arbitrage with bots work?Jun 16, 20236m

-

Want to manage your own Crypto Index Fund?Jun 16, 20236m

-

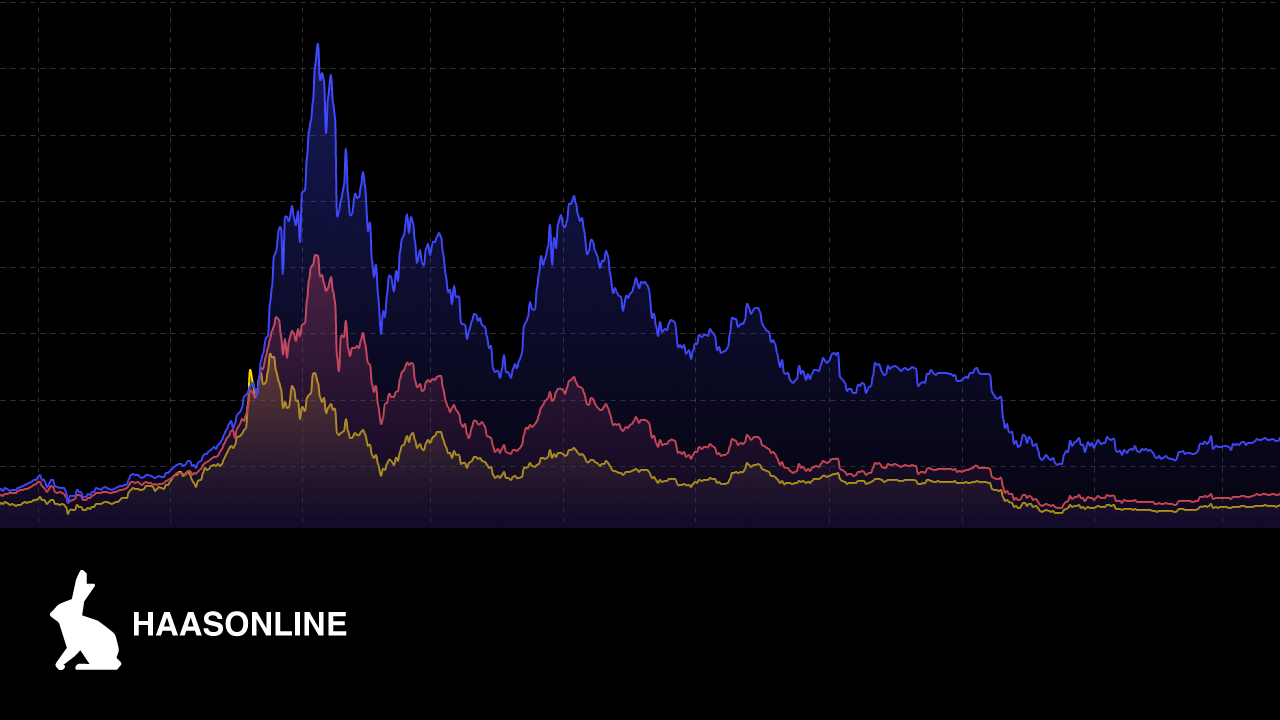

Simple Moving Average Trading Strategy with CryptocurrencyJun 16, 20235m

-

Bollinger Bands and CryptocurrencyJun 16, 20236m

-

Everything You Need to Know About Cryptocurrency ArbitrageJun 16, 20235m