How to use a crypto scalping trading strategy

Comments Off on How to use a crypto scalping trading strategy

Crypto Scalping with Crypto Trading Bots

If you’re familiar with foreign exchange (Forex) trading, you will probably have already heard of the term “scalping.” Also called “scalp trading,” a scalp trade bot strategy is now widely used by cryptocurrency traders, which is conveniently available as a custom trading bot inside HaasOnline TradeServer. Proponents of scalp trading say that this trading strategy can turn a profit quickly, but how exactly does it work when you’re trading with digital currencies such as Bitcoin?

We’ll define Bitcoin scalping in more detail if you aren’t already familiar with this specific trading method, then go into some ways you can use it to your advantage when trading with cryptocurrencies.

What is Scalp Trading?

Scalp trading is a historically proven, lower-risk, and short-term form of trading that makes smaller profits with less risk. Scalp traders make this happen by quickly initiating a series of small trades. Over the course of a trading session, the profit from each of those trades can add up to pretty substantial profit margins.

Speed and focus are needed to pull this off consistently, which is why experienced crypto traders utilize automated bitcoin software, like HaasOnline TradeServer. Our products are designed to help you identify historically profitable patterns and execute trades based on signals generated from using a well configured scalp trading bot.

Crypto scalp traders will monitor the price of a crypto pair, like BTC/USD or ETH/BTC, to take advantage of price fluctuations in order to make a series of profit from each of the small trades. When the price goes up, you take advantage of the increased trading volume, which adds market liquidity. The liquidity allows you to enter and exit trades faster with the intent of never holding the targeted digital asset for long-term. Once your dynamically generated target price is reached, sell signals are generated exiting you out of your positions with a small profit.

One very important thing to keep in mind while executing the scalping trading strategy are the trading and exchange fees. Since you’ll be making a large amount of trades back-to-back and most exchanges charge nominal maker and taker fees for each trade, it is essential that you have the risk capital and profit margin to cover the fees you’ll incur while executing your scalping strategy.

Exchanges that promote liquidity typically offer incentives to reduce the trading fees for traders. These incentives are often associated with an exchange specific token (like Binance’s BNB) that can be used to further reduce trading fees, oftentimes up to a 50% discount.

Bitcoin Scalping vs. Altcoin Scalping

Relative to other cryptocurrencies, Bitcoin tends to be the most stable of their volatile siblings. That means less profit per trade, but also more reliability for your scalping trading strategy, as predicted with technical analysis that Bitcoin will hold its value over the course of your trading session. This makes Bitcoin scalping one of the most popular forms of scalp trading in the crypto market.

Altcoins, on the other hand, can have enormous differences in price, especially if they’re smaller coins not backed by a reputable team or investment. Something could go wrong, or the coin could be delisted, along with any profit you’ll have made on those trades. If the coin isn’t worth much, the price you pay in trading fees could be more than you make from executing the trades.

Whichever cryptocurrency you decide to try scalp trading with, patience and focus are key. Don’t get frustrated and give up right away if you don’t turn a profit in the first few minutes. It takes time to familiarize yourself with trade automation software and scripts or even if you are manually executing scalp trading.

When Is a Good Time to Scalp Trade Crypto?

If you know what to look out for, with time and practice you can determine whether or not the current market favors a scalp trading strategy.

Three market factors that experienced traders watch are:

- Relative Strength Index (RSI): This is a momentum indicator calculated by looking at recent price changes. The RSI evaluates whether an asset like Litecoin is overbought or oversold, and is displayed as a line graph. It can have a value between 0 and 100. An RSI of 70 and above usually indicates an asset is being overbought or overvalued, thus it’s a good time to sell. An RSI of 30 or below indicates the opposite: it’s undervalued, primed for a price increase, and therefore its a good time to buy.

- Support and Resistance Levels: An asset’s support and resistance levels will change as it increases or decreases in price. That change can cause an asset to experience a concentration in demand and trend downward (support), or an increase in demand as price drops (resistance).

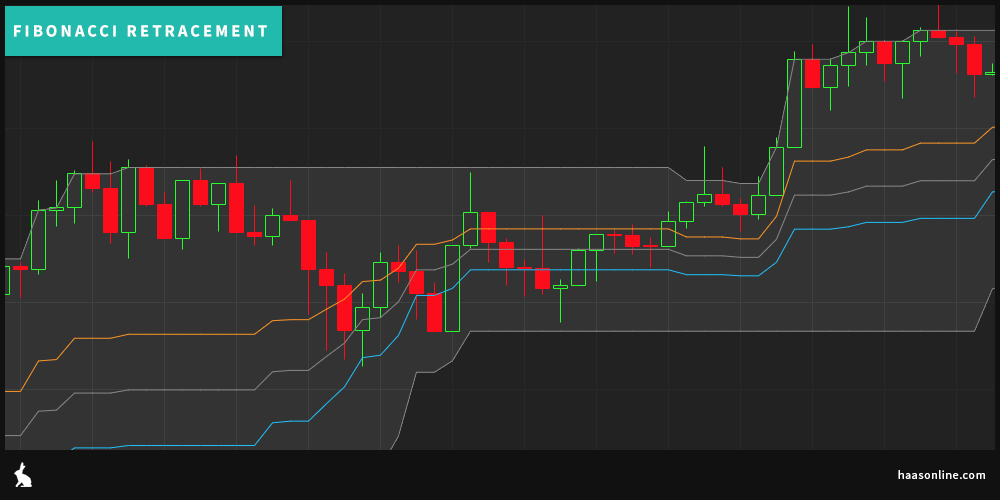

- The Moving Average: Traders use this to get an idea of where the price of an asset is headed, using past data to extrapolate what it will sell for in the future.

Some traders rely on charts to track these indicators manually, but using trade automation software like HaasOnline TradeServer can help you analyze and act on the same data much more quickly.

Pros and Cons of Cryptocurrency Scalp Trading

Scalp trading allows for the opportunity for lots of small profits taken from batches of small trades that build up quickly. However, those profits can be wiped out if trading fees exceed the value generated from those trades. One large loss can also negate the profits from a scalp trading session. As such, it’s very important that the trader has a stop-loss strategy in place to minimize or mitigate their profit losses if the market conditions are changing in a way that negatively impacts the active trading strategy.

Trading with bots lets you make trades based on signals from exchange and market data. The trader’s emotions are taken out of the picture, as they aren’t watching the value of their assets rise and fall, or seeing huge changes in the market while trying to evaluate their trade.

However, you can suffer losses if you set a trade bot to trade and market conditions change, rendering your initial strategy useless. If you’re not around to course-correct, you could wind up with more losses than you otherwise would have. Oftentimes, the first strategy a trader comes up with ends up being wrong. If you’re using trading bots, make sure you check-in on them every so often to make sure your strategy is still performing soundly.

Best Practices for Crypto Scalping

As with anything else, becoming a skillful investor takes time and practice, especially in a market as relatively new as cryptocurrency trading. However, there are a few tips you can follow to help yourself become a better trader right out of the gate while using a scalp trading strategy:

- Avoid altcoins with low volume; you may not be able to trade enough of them to turn a profit

- Know your plan beforehand and stick to it, leaving room for adaptation

- Have a good exit strategy

- Don’t put all your assets into a single trade, a good rule of thumb is no more than 2% of your risk capital

- Remember to account for fees and make sure you can cover them. Use HaasBot safeties and insurances to automate

- Follow the proper technical indicators (discussed above)

Also, if you decide to use our crypto trading bots, remember to monitor them regularly as they execute trades automatically and often need manual intervention to account for unexpected changes in the market conditions.

HaasOnline’s crypto trading bots maintain user privacy, don’t charge extra trade fees, and have no trade volume restrictions. They also allow you to backtest and paper trade your scalp trading strategies with historical and real-time exchange data, giving you a better picture of the performance of your strategy and allowing for well-informed decisions.

Consider taking HaasOnline TradeServer for a 14-day test drive with a discounted trial license.